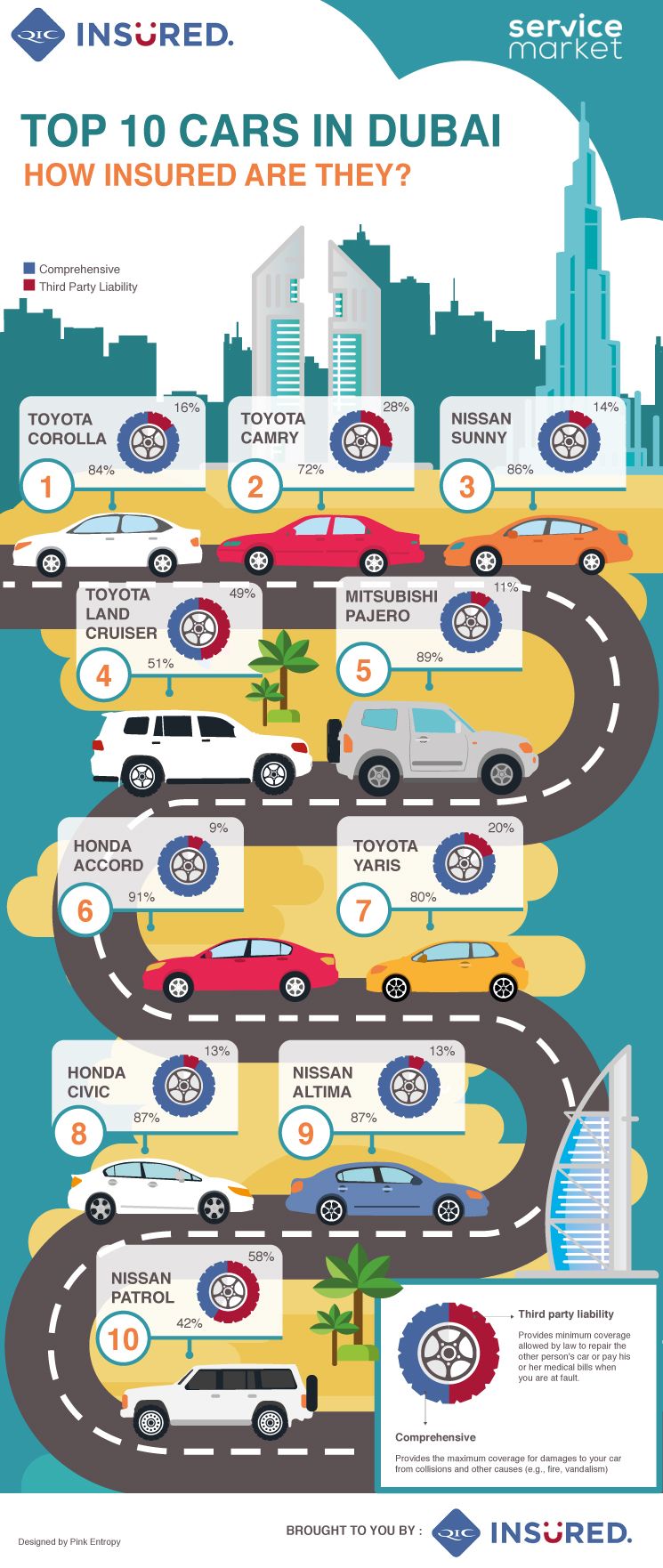

All UAE drivers know that car insurance is mandatory, but not all insurance is created equal. A recent investigation by QIC Insured and ServiceMarket spanning over 45,000 cars has revealed the top 10 most common cars in Dubai:

- Toyota Corolla

- Toyota Camry

- Nissan Sunny

- Toyota Land Cruiser

- Mitsubishi Pajero

- Honda Accord

- Toyota Yaris

- Honda Civic

- Nissan Altima

- Nissan Patrol

More generally, 2 in 10 of all Dubai cars are under-insured. What makes an under-insured car? Under-insured cars are those covered only by a third party liability policy, despite being eligible for comprehensive insurance. Frederik Bisbjerg, Executive Vice President MENA Retail, QIC Insured, explains that it is important for consumers to understand the two different types of insurance in the market to know how to properly insure their vehicles:

- Comprehensive insurance provides coverage for damages to the driver, passenger and vehicle resulting from collisions and other causes (e.g., fire, vandalism), regardless of who is at fault.

- Third party liability insurance provides minimum coverage allowed by law and will only pay to repair the other person’s car or cover his or her medical bills.

A good example of under-insured cars can be seen in the above infographic. It highlights the Toyota Land Cruiser (#4) and the Nissan Patrol (#10) as the most frequently under-insured cars, at 49% and 58%, respectively. Explaining this phenomenon, Mr. Bisbjerg remarks, “Drivers who own larger, high-end cars tend to make riskier insurance choices. They often think, ‘I won’t cause an accident…I’d rather save on the insurance and just get third-party. This line of thinking puts the vehicle owner at risk, since they will be on the hook for fixing their own car or paying for any outstanding car loans if they cause an accident.”

ServiceMarket CEO Bana Shomali adds two tips for those shopping for car insurance.

- If you have a car loan, you should check with your lender (bank, dealership, etc.) because your financing conditions will most likely require you to have comprehensive coverage.

- Find out what your car is really worth. This will give you an idea what it will cost to fix it if something happens. If your car is a recent model, buying comprehensive insurance might be a smart investment. However, with older cars, you may be confident that you could afford to pay to repair or replace it.

“The UAE market typically offers comprehensive insurance on car models from 2009 and later. If your car model year is 2008 or earlier, you may face difficulties getting a comprehensive policy – given that it is considered an older car”, explained Mr. Bisbjerg from QIC.

It may be tempting to save money on your annual car insurance premium by opting for third party liability. But first, you should weigh the higher premiums of comprehensive coverage against how much money it could cost you to repair or replace your car in the event of a loss. Comprehensive coverage can provide you the peace of mind of knowing you are protected no matter what.