Despite the tax-free environment, a combination of factors such as high rents, food bills and the extravagant Dubai lifestyle, means many UAE residents are struggling to save money on a regular basis. ServiceMarket teamed up with HSBC to better understand current savings trends and to offer up some useful tips to help residents save more and prepare better for retirement.

What are the current saving habits?

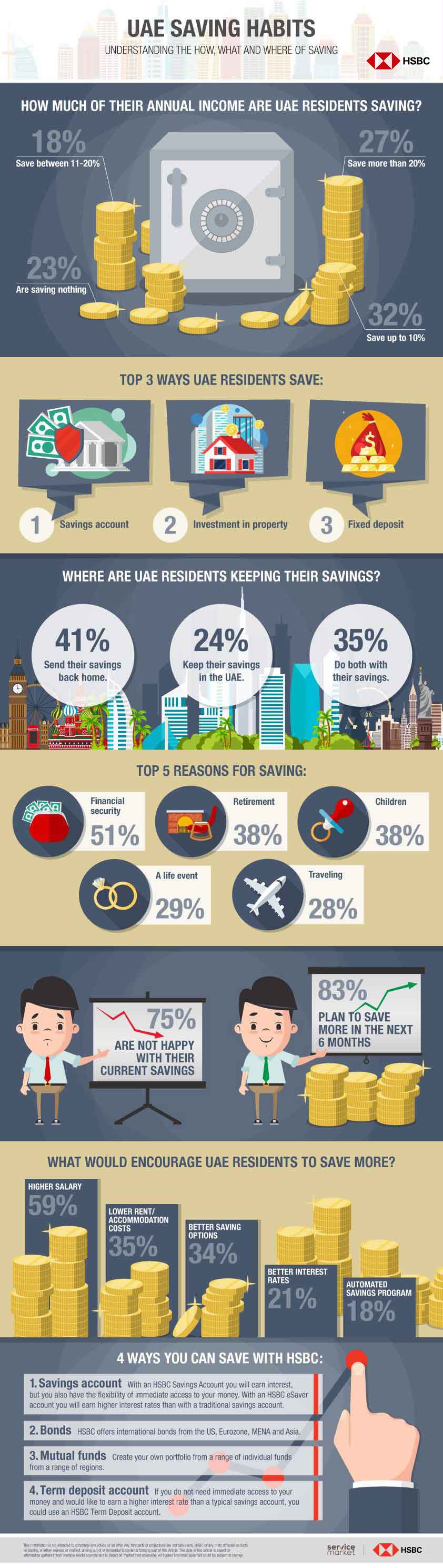

ServiceMarket ran a survey to understand current saving habits in the country. Shockingly, almost a quarter (23%) of UAE working respondents admitted that they are not managing to save anything, while a further third (32%) are saving under 10% of their monthly salary.

How are UAE residents saving their money?

Most UAE residents who are saving are doing so using a traditional savings account. Here are the top 5 ways people are saving their money:

- Savings account (64%)

- Investment in property (26%)

- Fixed deposits (20%)

- At home (e.g. in a safe) (18%)

- Investment in gold (17%)

Where are UAE savers keeping their savings?

Two-fifths (41%) of UAE savers send all their savings back home, 24% keep their savings in the UAE, and 35% do both.

What are they saving for?

The top reason for saving is for financial security, to have back-up money in case of job loss or emergencies. This is followed by saving for retirement and for children. The top 7 reasons given for saving are:

- For financial security

- Retirement

- Children (school fees, wedding, etc.)

- A life event (marriage, family event, etc.)

- To travel

- To buy property

- Education (e.g. to pay for higher education)

Perspective on current savings:

Three quarters are not happy with their current savings, however respondents are more optimistic about the upcoming months. Eight in every ten respondents (83%) stated that they plan to save more in the next 6 months.

What would help respondents to save more?

Perhaps unsurprisingly, over half of UAE respondents stated that having a higher salary (59%) would encourage them to save more, followed by 35% who felt high rents and accommodation costs were a barrier for them to save. The top 5 factors that would encourage respondents to save more are:

- A higher salary (59%)

- Lower rents/ accommodation costs (35%)

- Better saving options (bonds, fixed deposits, etc.) (34%)

- Better interest rates (21%)

- An automated savings program (which takes money out of the account automatically every month) (18%)

Tips to help you save more

- Develop a savings plan and stick to it. Put aside a set amount of money at the start of each month, but be realistic. Consider your main expenses and set yourself a realistic target.

- Cut down on expenses: Ask yourself if there are any expenses that you can reduce or remove. For example, you could save money by bringing food to work with you, rather than eating out every day. Be frugal, try to save money by switching to cheaper brands.

- Save any additional or unexpected money: Rather than spending your bonus on fancy items you don’t really need, immediately put the money into a savings instrument.

- Have a “Buy Nothing Day”: Set yourself a rule that you are not allowed to buy anything unnecessary on one day of the week. This includes your morning coffee, and any impulse purchases – you would be surprised how much you can save this way.

- Use coupons and discounts: Use coupons to save money. For example, the Entertainer app has a bunch of 2-for-1 offers that could save you a lot of money when dining out.

- Shop around and compare: Don’t buy the first thing that you find. Do your research and compare multiple options to find the best deal. Sites like ServiceMarket allow you to get multiple quotes for home services easily.

- Open a savings account: Having a savings account is a great way to start saving. With an HSBC savings account, you earn interest but you also have the flexibility of immediate access to your money. You can also choose between AED, USD, GBP, EUR and RMB account currencies. HSBC’s “eSaver” account offers higher interest rates than a normal savings account, and if you do not need immediate access to your money and would like to earn a higher interest rate than a typical savings account, you could use an HSBC Term Deposit account.

- Diversify your savings: With HSBC, you can create your own portfolio from a range of funds like equities, bonds and specialist investments. HSBC offers a wide selection of mutual funds and offshore investments and international bonds from the US, Eurozone, MENA and Asia.

- Pension plan: If you don’t have a pension plan, sign up for one. Too many expats leave the UAE without any money set aside for their retirement.

* This information is not intended to constitute any advice or an offer. Any forecasts or projections are indicative only. HSBC or any of its affiliates accepts no liability, whether express or implied, arising out of or incidental to contents forming part of this Article. The data in this article is based on information gathered from multiple media sources and is based on market best scenarios. All figures and rates specified could be subject to change.