Despite excellent roads, extensive traffic laws and ideal driving conditions, the UAE isn’t completely accident-free. Just last year, a staggering 100,000 traffic violations were reported in Dubai alone, while the death-toll for traffic-related accidents reached an unfortunate 198. It might come as a shock to many that seemingly minor violations such as changing lanes suddenly and not leaving enough distance between cars while driving are two of the most common causes of accidents in Dubai. Scary, right? The only way to make one’s roads safer is to drive lawfully and responsibly. Sadly, while you might do your utmost in observing traffic rules and regulations, you can’t say the same about everyone else which makes it all the more important to buy the best car insurance policy with good coverage.

The folks here at ServiceMarket work closely with leading car insurance companies in the UAE, and we’ve managed to gain an excellent understanding of car insurance industry trends. If you want a breakdown of the nitty-gritty of car accident claims in the UAE, here’s our insider’s look:

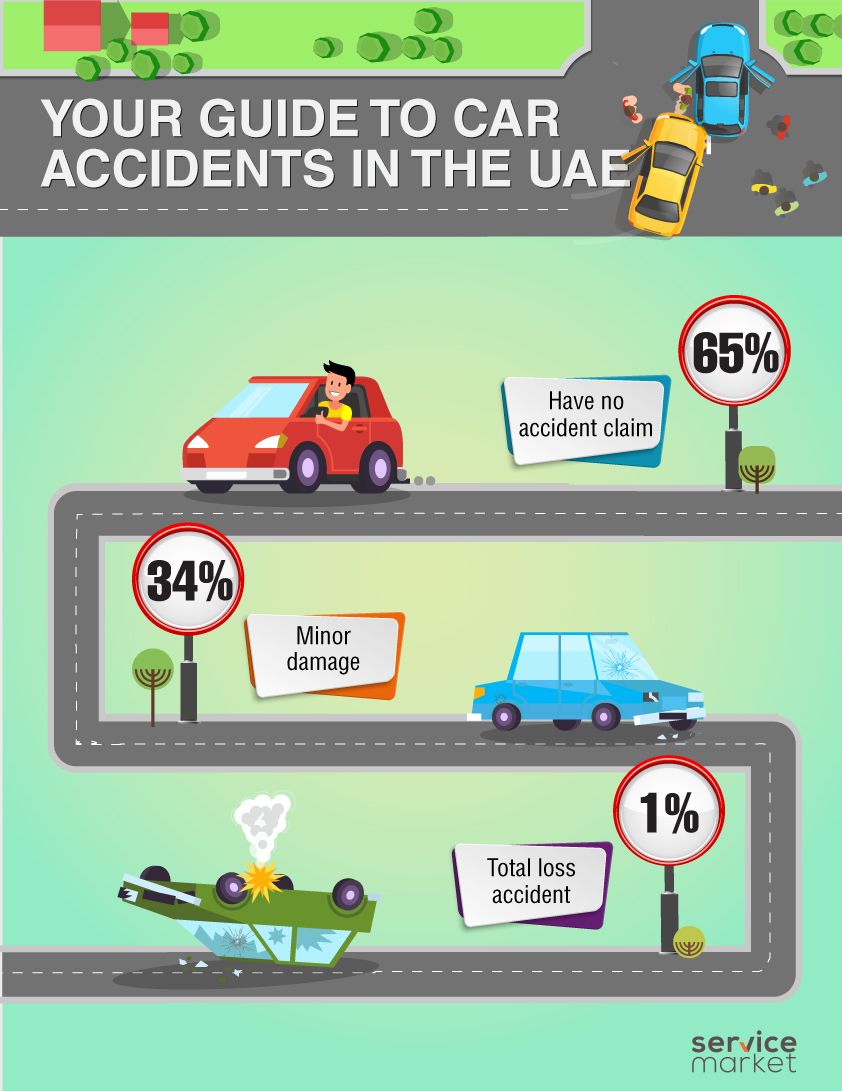

- On average, only 1% of UAE motorists have a total loss accident each year. What does a “total loss” mean? Simply that the damage to your car is so bad that it cannot be repaired or when it doesn’t pay off to repair the car (repair cost is higher than the car value), so in case of a total loss accident the car is either replaced or the insurance company becomes liable to pay the value of your vehicle.

- Around a third of UAE drivers have minor accidents each year. If you have comprehensive insurance or the accident was not your fault then the insurance company will refer you to a garage to get your car repaired.

- Most drivers (we’re talking 65% here) don’t make any car insurance claims at all. Thank god for that!

Why this matters:

It’s important to keep track of trends, details and statistics that will better inform you when comparing car insurance policies and coverages.

You’ll need to provide certain details to the insurance company for when you’re buying a policy, including the estimated market value of your vehicle. This is necessary because the company can use this to calculate the amount that will be given to you in case you have a total loss accident. More importantly, the value you specify for your car is used to calculate the insurance premium you pay. The higher the car value you specify, the more you will pay for your car insurance.

Don’t go for a high car value with a total loss scenario in mind, though. This might be a strange thing to say, but when the likelihood of you being involved in a total loss car accident is just 1%, it doesn’t make a whole lot of sense to pay more for something that has very little chance of happening. And obviously, for normal repairs the car value you choose makes no difference. Therefore, it’s a good idea to choose a car value at the lower end of the range instead since your insurance premiums will be calculated based on it!

ServiceMarket can make your hunt for a good car insurance easier. Just input your details and we’ll provide you with an approximate range for the value of your car within seconds. Visit the site today to get free quotes, compare policies and choose the best insurance for your car!